Azerbaijan's surplus in trade turnover promises positive forecast for manat's rate

Due to global occurrences, the national currencies of neighboring countries are always subject to fluctuation, and this poses concerns in Azerbaijan. It is not questionable that the Azerbaijani manat is one of the most stable currencies in the world, however, many still remember the devaluation of the manat happened in 2015.

Take up, the Turkish lira, for example, which continued to depreciate in 2023, as well. The devaluation of Lira started in 2013. Following the political crises, such as the Gezi events in 2013 and the coup attempt in July 2016, the devaluation got more intensified. Thus, the lira’s devaluation accelerated in 2021 when it went beyond single-digit figures and reached a value of 10 in the lira-dollar rate.

Besides, Turkiye’s trade turnover results in deficits so the country every year needs to find extra foreign currency which also triggers devalution. Given all the above, many experts believe that Turkish Lira will not return to its position in 2014 again.

Russian ruble share the same fate with the Turkish lira, in other words, the Ruble is depreciating versus the US Dollars. Like the Lira, the Russian Ruble started to depreciate in 2014 and the depreciation accelerated in 2022 and peaked at 124. However, unlike the Turkish lira, the later Ruble appreciated and returned to its previous position and again started to gradually devaluate. Despite both currencies starting to devaluate in the 2010s, the main driver of devaluation was totally different. Unlike the Lira, the depreciation of the Ruble stems from Russian foreign policy, more precisely the conflict with Ukraine. As is known, the first phase of this conflict started in 2014. At that time, the Western countries imposed some sanctions on Russia, and the Ruble depreciated by roughly twice. When the second phase of the conflict commenced in 2022 with the invasion of Ukraine, the West furthered the sanctions and many expected sharp depreciation again. However, the Ruble peaked at 124 and then lowered to its previous position. It seems Russia learned its lesson from previous occurrences and prepared for it. The sharp decrease in Russian trade surpluses was the main drive for this depreciation, but later Moscow found new ways to evade these sanctions. Currently, the rate of the Ruble gradually lowers.

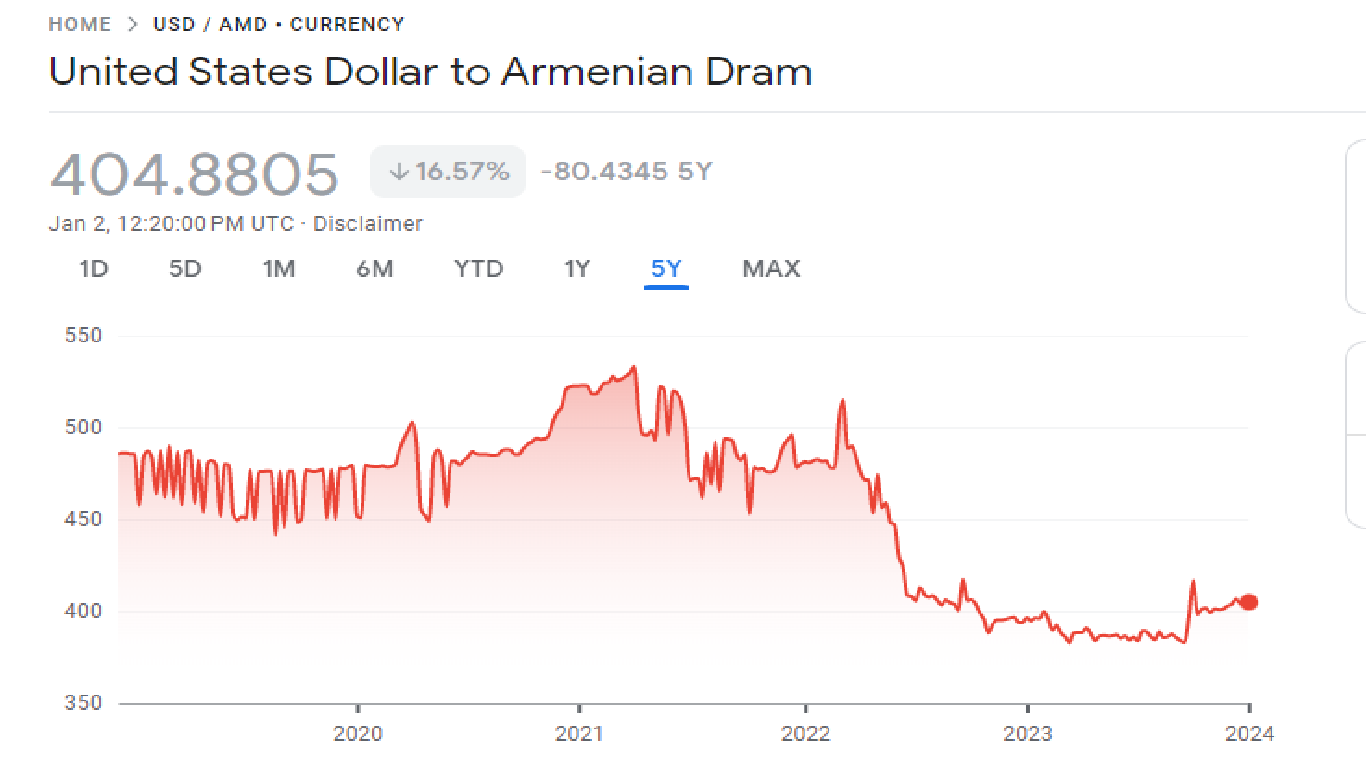

As for the national currencies of Georgia and Armenia, they get value. It is worth noting that these two countries, especially Armenia, reap the benefits of the Ukrainian crisis. When the second phase of the Ukrainian crisis started, many people belonging to the middle class left Russia for these two countries of the South Caucasus. The foreign currencies that these people took with them played a great role in the appreciation of the national currencies of Georgia and Armenia. However, from the charts, we see that the impact of Russian migrants on the national currency of the two South Caucasus countries is gradually wading away.

As for Azerbaijan's manat, it is worth noting that it is one of the most stable national currencies in the world. Azerbaijan can keep the stable rate with the help of its trade surpluses. It should be noted that Azerbaijan's foreign trade turnover has resulted deficit just seven times for 30 years. It always results in surpluses.

The volume of the surpluses indeed decreases year by year, it is big enough to keep the rate of national currency stable. Some can remember that despite having trade surpluses, the value of Azerbaijan's manat depreciated twice in 2015. Azerbaijan's foreign trade turnover indeed resulted in surpluses worth $2.2bn in 2015. However, at that time depreciation of the national currency of all neighboring countries created an expectation in Azerbaijan as well. Many believe speculation following this expectation caused the devaluation. Currently, it is crystal clear that the government has taken strict measures against such speculation. Besides, given measures taken in global oil and gas markets and Azerbaijan's promise to double natural gas export to Europe, some can easily conclude that in 2024 trade turnover of Azerbaijan will most probably result in surpluses as well and it foreshadows that the rate of manat will be same throughout the year.

---

Qabil Ashirov is AzerNews’ staff journalist, follow him on Twitter: @g_Ashirov

Follow us on Twitter @AzerNewsAz

Here we are to serve you with news right now. It does not cost much, but worth your attention.

Choose to support open, independent, quality journalism and subscribe on a monthly basis.

By subscribing to our online newspaper, you can have full digital access to all news, analysis, and much more.

You can also follow AzerNEWS on Twitter @AzerNewsAz or Facebook @AzerNewsNewspaper

Thank you!